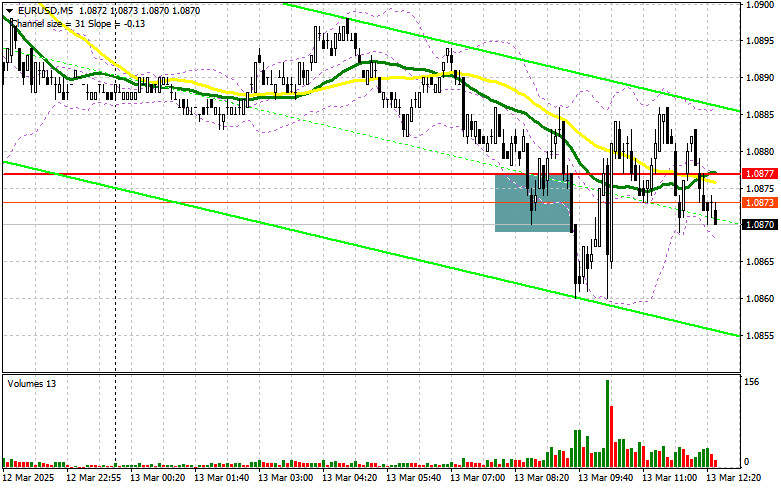

In my morning forecast, I focused on the 1.0877 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. A decline and a false breakout around 1.0877 provided an excellent entry point for long positions, but the pair failed to see significant growth as trading remained centered around this level. The technical picture has been revised for the second half of the day.

To Open Long Positions on EUR/USD:

In the absence of key statistics, euro buyers attempted to establish some momentum around 1.0877, but a more substantial rally and an update of the monthly high did not materialize. This is another warning sign for bulls, especially after they failed to capitalize on yesterday's U.S. inflation data and the rather restrictive stance of ECB President Christine Lagarde. Another important U.S. report is expected in the second half of the day, specifically the Producer Price Index (PPI) and core PPI (excluding food and energy) for February. An increase in inflation will help the Fed solidify its future stance, strengthening the U.S. dollar. A decrease in inflation would give the Fed more flexibility to adopt a dovish stance, as many anticipate after yesterday's CPI data.

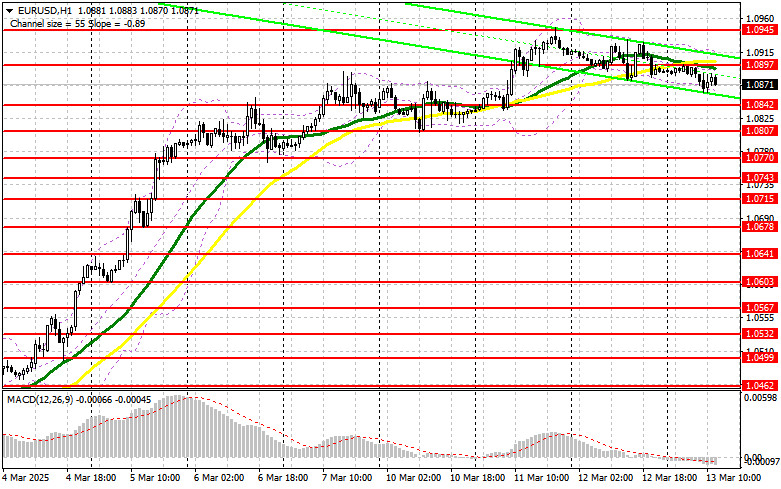

If the euro falls, only a false breakout around 1.0842—similar to the setup discussed earlier—will provide an opportunity for new EUR/USD purchases, aiming for further bullish market development with a potential update to 1.0897, the middle of the sideways channel. A breakout and retest of this range would confirm a valid entry point for buying, targeting 1.0945. The furthest target would be the 1.0997 level, where I will take profits. If EUR/USD declines and shows no activity around 1.0842, the pair could enter a significant correction, allowing sellers to push it down to 1.0807. Only after a false breakout at this level will I consider buying the euro. I plan to open long positions immediately on a rebound from 1.0770, targeting an intraday upward correction of 30-35 points.

To Open Short Positions on EUR/USD:

Sellers are cautiously observing the market but prefer to act only on upward movements. If EUR/USD rises following the U.S. inflation data, only a false breakout around 1.0897—where the moving averages also support sellers—will provide an opportunity to enter short positions, aiming for a correction toward the 1.0842 support area. A breakout and consolidation below this range would be another valid selling scenario, targeting 1.0807. The furthest target would be 1.0770, where I will take profits.

If EUR/USD moves upward in the second half of the day and bears fail to act at 1.0897—which I personally doubt—buyers could drive another strong rally in the pair. In this case, I will postpone short positions until the next resistance at 1.0945. I will sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.0997, aiming for a 30-35 point downward correction.

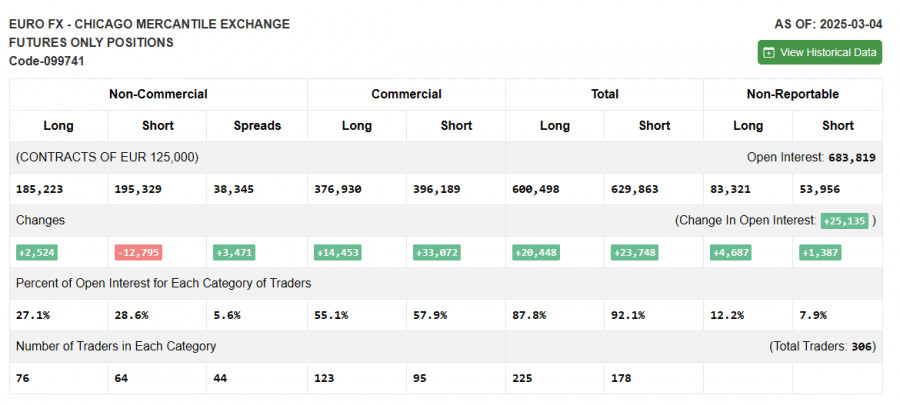

The Commitment of Traders (COT) report for March 4 showed an increase in long positions and a significant reduction in short positions. Interest in buying the euro continues to grow. Germany's new fiscal policy aimed at economic stimulus has renewed demand for the euro, leading to a notable strengthening against the U.S. dollar. The ECB's cautious stance on future rate cuts also supported EUR/USD demand, as reflected in the report. The slight advantage for euro sellers is no longer as impactful as before, but caution is advised when buying at current highs.

The COT report showed that long non-commercial positions increased by 2,524, reaching 185,223, while short non-commercial positions decreased by 12,795, falling to 195,329. As a result, the gap between long and short positions widened by 3,471.

Indicator Signals:

Moving Averages: Trading is occurring near the 30-day and 50-day moving averages, indicating market uncertainty.

Note: The period and prices of moving averages analyzed by the author are based on the H1 chart and differ from the classic daily moving averages on the D1 chart.

Bollinger Bands: In case of a decline, the lower boundary of the indicator around 1.0872 will act as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing out volatility and noise.

- Period 50 (yellow on the chart)

- Period 30 (green on the chart)

- MACD (Moving Average Convergence/Divergence):

- Fast EMA – 12-period

- Slow EMA – 26-period

- SMA – 9-period

- Bollinger Bands: 20-period

- Non-commercial traders: Speculators, including individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total long open positions held by non-commercial traders.

- Short non-commercial positions: Total short open positions held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.