Hi, dear colleagues!

The US dollar, and euro, and crude oil are three pillars among other assets that arouse the most interest among traders and investors. Let's try to figure out their outlook amid such a complicated background in global financial markets. Today I would like to discuss weird things of the current moment indicating that the US dollar is setting a trap for the global financial system.

In light of the sanctions on Russia's gold and forex reserves slapped as a punishment for the military intrusion into Ukraine, we can see that the US dollar and the euro are the flip sides of the same coin. This is obvious looking at any currency pair. Forex crosses are an exception, though all currencies in them are traded relative to the US dollar. After Russia had been cut off from SWIFT and after other sanctions had been imposed, the Russian currency lost 50% of its value. At first glance, any troubles with the US dollar compared to the ruble's knockout are insignificant. Nevertheless, we cannot downplay the fallout from the dollar's problems. The ruble hitting rock bottom will cause trouble to the Russians and people from the neighboring countries. If something goes wrong with the US dollar and the euro, this would inflict damage to the whole global economy.

First of all, you and I need to understand that a fiat reserve currency system based on the US dollar is a well-balanced mechanism that allows the "golden billion" to benefit from having the very ability to create money from debt. The balance of power is characterized by the dollar exchange rate against other reserve currencies, which has remained unchanged for 50 years. At the moment the US dollar exchange rate is 97.95% against reserve currencies, where the 1973 level is taken as 100% (picture 1).

Pucture 1: USD exchange rate against other major currencies

Over the 50 years that have passed since the forex market came into existence, the forex rate of the American currency has not changed dramatically. This does not mean that the dollar exchange rate against a basket of foreign currencies has never changed at all. Over the past 5 years, its values have deviated from the level of 88 to the level of 104, but in general we can see that this deviation is around a constant value.

As you know, the euro exchange rate is actually the reverse exchange rate of the US dollar because the denominator of the European currency is the US dollar. In turn, the euro accounts for nearly 60% in the basket of major currencies. Therefore, it is not surprising that the EUR/USD chart looks very much like an inverted dollar index chart. At the same time, the movement of the euro exchange rate mirrors the movement of the dollar index. While the dollar index overcame resistance at 97, the EUR/USD exchange rate overcame support at 1.12 (picture 2).

From the point of view of intermarket technical analysis, such a movement is true, and the subsequent return of the rate to resistance or support is nothing more than a confirmation of the breakdown of an important level, which suggests further movement in the direction of the main trend, where in the case of the dollar index, this is growth. In the case of the EUR/USD rate, this is a decrease.

Picture 2: Technical analysis of EUR/USD

The reader who has read up to this point may ask: "What is strange here?" Indeed, there is nothing strange so far. All trends develop in line with classical technical analysis, which says that the indices should confirm each other. However, intermarket analysis also tells us that all markets are interconnected and cannot develop in isolation. Therefore, let's add the price of oil to our consideration, taking the American grade WTI, which is designated #CL on InstaForex trading platform.

It is common knowledge that oil is traded in US dollars or has a dollar as its equivalent. In fact, the oil quote looks like WTI / USD, where there is an oil contract instead of a currency ticker. This allows us to draw a conclusion about the multidirectional dynamics of the dollar and oil prices. In other words, an increase in the dollar should be accompanied by a decrease in the price of oil. Besides, a decrease in the EUR/USD should also be accompanied by a fall in oil prices.

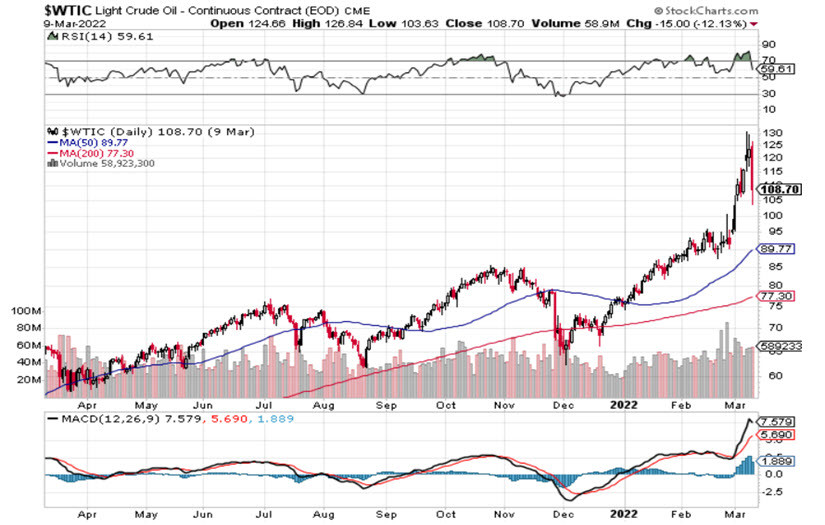

Assets do not correlate with each other, but have a close logical connection. There have been discrepancies in dynamics before, but usually they leveled out within one month. Nowadays, the price of oil has actually been growing non-stop since October 2020 (picture 3), while the euro has been actively declining since June 2021, i.e. already over the past 7 months, which is a critical fundamental factor.

In July 2021, the price of WTI oil was 65 euros (80 US dollars). In March 2022, the price of oil is already 100 euros (110 US dollars), an increase of about 54%. The price of oil rose in dollars as well, but in US currency the growth was about 38%.

Picture 3: Technical analysis of WTI #CL

The embargo imposed by the United States on imports of Russian oil, as well as the military clashes in Ukraine, caused an acute shortage in the energy market. One of the main Russian ports through which oil produced in Russia was transported for export, the Novorossiysk Commercial Sea Port, actually halted any shipments. At the same time, the cost of freight due to the threat of sanctions increased three and a half times, and the price of oil soared to multi-year records.

Therefore, statements that the UAE advocates for ramping up oil output by OPEC countries led to a drop in oil prices. The problem is that there are no reserve capacities for increasing oil production in the world now. Thus, the implementation of the embargo can be carried out only virtually so far, but this will not continue forever. A year later, the world will be able to do without Russian oil.

However, the problem is wider than just limiting the supply of energy resources from a single country, albeit a very large one. The problem is that the postulate of world trade based on the US dollar as the equivalent of value no longer works. The rally of oil prices in parallel with the depreciation of the euro testifies to this better than any other signs. The global economy built on the principle of uniform pricing through the market price does not exist anymore.

The price can still be measured in dollars, but it will not be set on American or European exchanges, but through direct contracts. Whether this is good or bad, time will tell. We see a reflection of the current situation in inflationary processes in developed Western countries, which threaten or have already gone out of control of central banks. Inflation data in the US and other countries have already conquered multi-decade highs. Central bank tools are very limited. So, in this regard, we should expect a significant decline in global stock markets in the next few months. Be careful and prudent! Follow the rules of money management!