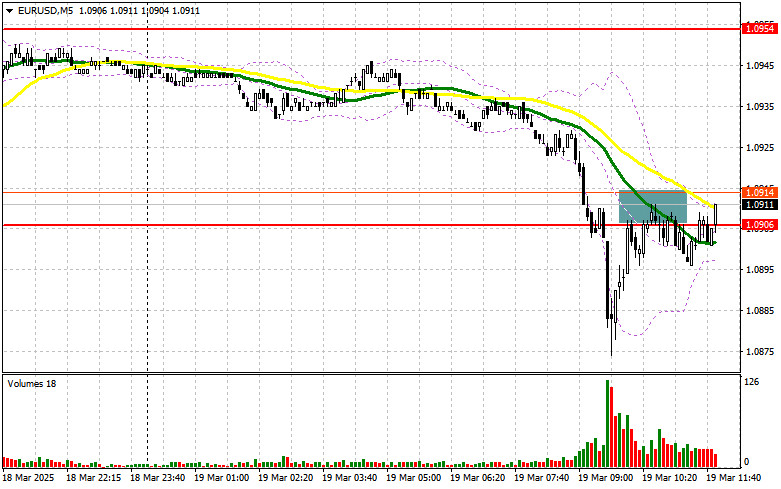

In my morning forecast, I highlighted the 1.0906 level as a key point for making market entry decisions. Let's examine the 5-minute chart to see what happened. A break and retest of 1.0906 provided a good entry point for selling EUR/USD along the downtrend, but the pair failed to decline significantly. The technical outlook has been revised for the second half of the day.

For Opening Long Positions on EUR/USD:

The euro declined after data showed that February inflation in the eurozone was revised downward to 2.3% from 2.4%, putting additional pressure on the pair. Profit-taking ahead of the Federal Reserve's monetary policy meeting also weighed on the euro. The meeting results, FOMC statement, and updated economic projections will be released later today, followed by Fed Chair Jerome Powell's press conference. A hawkish stance on interest rates could strengthen the US dollar, while a dovish outlook could support further euro growth.

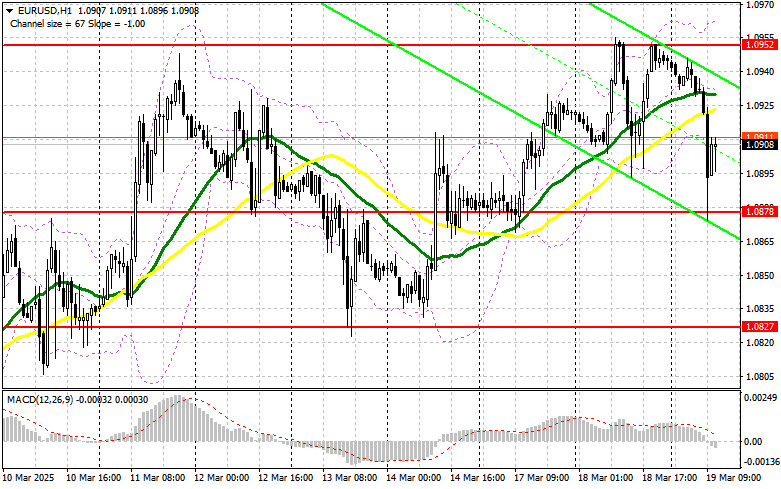

If the correction continues, only a false breakout at the 1.0878 support level, formed during the first half of the day, would provide a reason to buy EUR/USD, aiming for further development of the bullish market trend with a potential move to 1.0952. A break and retest of this range would confirm the correct buying point, with an extension to 1.0997, the new monthly high. The ultimate target would be 1.1047, where I plan to take profits.

If EUR/USD declines and shows no buying activity at 1.0878, the pair is likely to remain within the range, leading to a deeper correction. In this case, sellers could push the price to 1.0827, where I would consider entering long positions after a false breakout. I will only consider buying on a direct rebound from 1.0770, targeting a 30-35 point intraday correction.

For Opening Short Positions on EUR/USD:

Sellers successfully defended the 1.0952 level, preventing further euro appreciation. Now, the focus shifts to the Fed's decision and Powell's remarks. The 1.0952 resistance level remains key, determining whether the bullish market can continue. A false breakout at this level would create an opportunity to sell EUR/USD, targeting 1.0878 support. A break and consolidation below this range would provide an additional selling opportunity, pushing the pair down toward 1.0827. The final target would be 1.0770, where I plan to take profits.

If EUR/USD rises in the second half of the day and bears fail to defend 1.0952, buyers could attempt to extend the rally. In this case, I will delay short positions until the next resistance at 1.0997. Selling from this level would only be considered after an unsuccessful breakout attempt. If there is no downward movement at that level, I will look for short positions at 1.1047, expecting a 30-35 point correction.

Commitment of Traders (COT) Report:

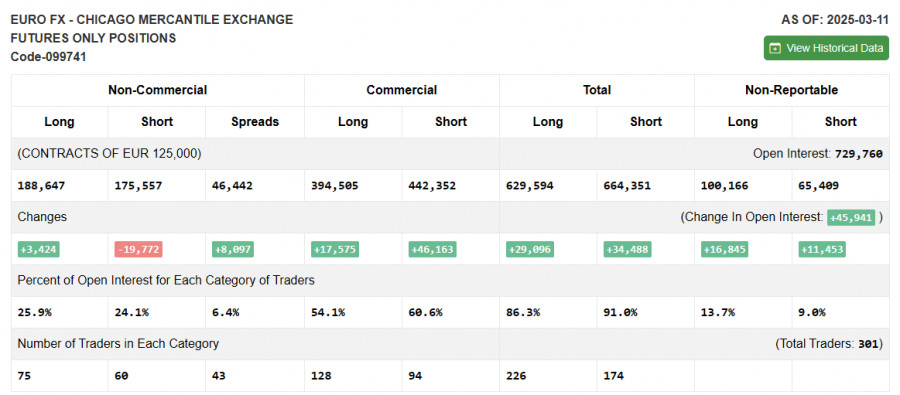

The COT report from March 11 showed an increase in long positions and a significant reduction in short positions. More traders are buying the euro, while sellers are rapidly leaving the market. Germany's fiscal stimulus policy and the ECB's active support continue to boost demand for the euro. Additionally, progress in resolving the Ukraine conflict contributes to positive sentiment.

With the Fed meeting approaching, if the central bank adopts a dovish stance, the US dollar could weaken further. The COT report indicates that long non-commercial positions increased by 3,424 to 188,647, while short non-commercial positions decreased by 19,772 to 175,557. As a result, the gap between long and short positions widened by 8,097.

Indicator Signals:

Moving Averages: Trading is occurring near the 30- and 50-day moving averages, indicating market uncertainty.

Bollinger Bands: If the pair declines, the lower boundary of the indicator around 1.0900 will act as support.

Indicator Descriptions:

- Moving Averages (smooth volatility and noise to identify trends):

- 50-period SMA – Yellow on the chart

- 30-period SMA – Green on the chart

- MACD Indicator (Moving Average Convergence/Divergence):

- Fast EMA (12), Slow EMA (26), SMA (9)

- Bollinger Bands (volatility-based price bands):

- Non-commercial traders: Speculative market participants, such as individual traders, hedge funds, and large institutions using futures for speculative purposes.

- Long non-commercial positions: The total open long positions held by speculative traders.

- Short non-commercial positions: The total open short positions held by speculative traders.

- Net non-commercial position: The difference between short and long positions among speculative traders.