GBP/USD also traded higher on Monday, but it was less pronounced than the EUR/USD. First, the basis for the rise can only be technical at the moment. Last week, both currency pairs failed to break through significant support levels, so any rise in a downtrend is merely a correction. On Monday, many did not expect to see the pair rise before the scheduled reports were published in Europe, Britain, and the US. However, it should be noted that the market moves not only when there are economic reports or fundamental events. Last week's movements were very weak, but the pair has been showing such low volatility for a long time.

The new consolidation above the moving average line means absolutely nothing. The chart clearly shows that during the last upward movement, the pair consolidated below the moving average about five times. And the pair did not decline each time. Now the situation is the opposite. We believe that a local trend reversal to the downside has occurred, and now every consolidation above the moving average does not lead to a change in trend. Therefore, we still expect the pound to fall in one way or another. As a reminder, the pound sterling has shown illogical movements for the last six months, and this week much will depend on the US macro data. If key reports turn out weaker than expected, the pound sterling may appreciate. However, we still believe in a sharp fall.

This week, apart from the business activity indices in the services, manufacturing, and construction sectors, there's nothing else to highlight in the UK. These are second estimates of the indicators, which are objectively less important than the initial estimates. Therefore, the market will entirely focus on labor market data, unemployment, and business activity in the US. The first important report, the US ISM manufacturing index, was published on Monday. By the end of the week, the second ISM index, the ADP report (comparable to the NonFarm Payrolls data), the JOLTs report on the number of job openings, the NonFarm Payrolls report, unemployment, and wages will be released. We've listed the most important reports. Even if the market ignores half of these reports (due to neutral values, for example), the remaining half should significantly influence the pair's movement.

Of course, making predictions about where the pair will be by the end of the week, given such strong reports, is pointless. We do not know what values the reports will show. Therefore, traders will have to react to each report in real-time. We can only say one thing: regardless of the US data, they will not negate the need to continue the downward trend. The market may once again cling to any formal reason to buy the pound, but in that case, we will be powerless. Let us remind you that we analyze the technical, fundamental, and macroeconomic background. If the market or its major players ignore the technicals and the news reports, we will not see logical movements.

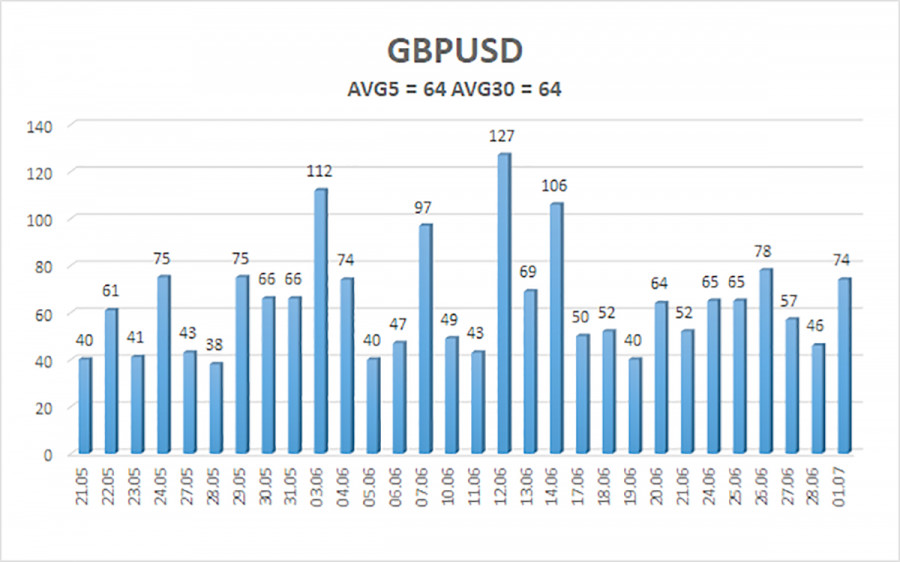

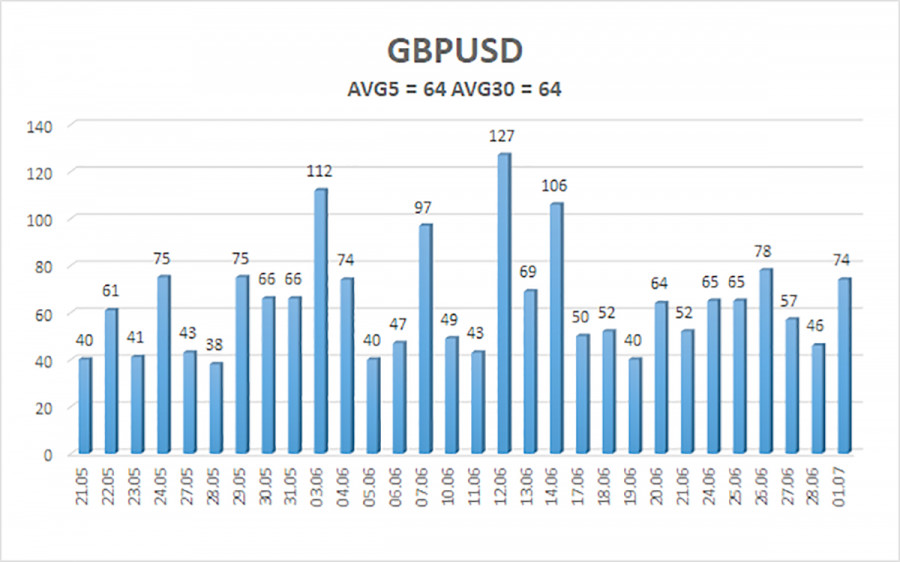

The average volatility of GBP/USD over the last five trading days is 64 pips. This is considered a "moderately low" value for the pair. Today, we expect GBP/USD to move within a range bounded by the levels of 1.2581 and 1.2709. The higher linear regression channel is pointing upwards, which suggests that the upward trend will continue. The CCI indicator entered the overbought and oversold areas recently.

Nearest support levels:

S1 - 1.2634

S2 - 1.2604

S3 - 1.2573

Nearest resistance levels:

R1 - 1.2665

R2 - 1.2695

R3 - 1.2726

Trading Recommendations:

The GBP/USD pair has once again consolidated below the moving average line and is trying to break the upward trend of the previous months. After consolidating below the moving average line and overcoming the area of 1.2680-1.2695, the pound has better chances of falling further. However, traders should be cautious with any positions on the British currency. There is still no reason to buy it, and it is risky to sell, because the market ignored the fundamental and macroeconomic background for two months, and often simply refused to sell the pair. Nevertheless, only short positions can be considered relevant with targets of 1.2604 and 1.2586, if we are talking about a logical and natural movement.

Explanation of Illustrations:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.